POLITICS

What is ESG? Definition and meaning

ESG stands for Environmental Social and Governance and refers to the three key factors when measuring the sustainability and ethical impact of an investment in a business or company. Most socially responsible investors check companies out using ESG criteria to screen investments.

It is a generic term used in capital markets and commonly used by investors to evaluate the behavior of companies, as well as determine their future financial performance.

The Environmental Social and Governance factors are a subset of non-financial performance indicators which include ethical, sustainable, and corporate governance issues such as making sure there are systems in place to ensure accountability and manage the corporation’s carbon footprint.

The number of investment funds that incorporate ESG factors has been growing rapidly since the beginning of this decade and is expected to continue rising significantly over the decade to come.

What Does ESG Stand For?

ESG is an acronym for Environmental, Social, and Governance, which refers to three key areas that are evaluated to determine a company’s sustainability and ethical practices. Let’s delve deeper into each aspect to gain a better understanding.

1. Environmental Factors: Caring for Our Planet

The “E” in ESG represents the environmental aspect, which focuses on a company’s commitment to sustainable practices and reducing its environmental impact. These factors include but are not limited to:

a. Carbon Footprint:

Companies that actively work to minimize their carbon footprint through energy-efficient operations and renewable energy sourcing are seen as environmentally responsible.

b. Waste Management:

Effective waste management practices, such as recycling and proper waste disposal, demonstrate a company’s dedication to preserving the environment.

c. Resource Conservation:

Using resources efficiently and responsibly, like water and raw materials, is a crucial factor in assessing a company’s environmental efforts.

2. Social Factors: Impact on Society

The “S” in ESG stands for social factors, which gauge a company’s relationships with its employees, customers, communities, and other stakeholders. Key social aspects include:

a. Employee Welfare:

Companies that prioritize employee welfare, safety, and offer fair compensation tend to perform better on the social scale.

b. Diversity and Inclusion:

Promoting diversity and inclusion within the workforce not only fosters a positive work environment but also showcases a company’s commitment to social equality.

c. Community Engagement:

Engaging with local communities and supporting social initiatives contributes to a company’s positive social impact.

3. Governance Factors: Ethical Leadership

The “G” in ESG represents governance, which deals with the internal systems and practices governing a company. Factors under governance include:

a. Transparency:

Transparency in financial reporting and decision-making processes is a crucial aspect of good governance.

b. Board Independence:

Having an independent board of directors ensures unbiased decision-making for the betterment of the company and its stakeholders.

c. Executive Compensation:

Appropriate and fair executive compensation is a reflection of responsible governance practices.

Why ESG Matters: The Business Case

Understanding the meaning of ESG is just the beginning. Now, let’s explore why ESG matters and the business benefits it brings.

1. Attracting Investors and Stakeholders:

ESG considerations have become a key aspect of investment decisions. Investors, particularly those focused on sustainable investments, prioritize companies that demonstrate a commitment to ESG principles. By incorporating strong ESG practices, your company can attract a broader pool of investors and stakeholders who align with your values and long-term vision.

2. Mitigating Risks:

Addressing environmental and social risks proactively can help businesses avoid potential reputational and financial damage. By identifying and mitigating risks associated with environmental and social factors, companies can enhance their resilience and create a positive public perception.

3. Fostering Innovation and Efficiency:

Embracing ESG practices often leads to innovation in products, services, and processes. Companies that are environmentally conscious tend to develop more sustainable solutions, which can drive cost savings and operational efficiencies in the long run.

4. Strengthening Brand Reputation:

Being a responsible corporate citizen can significantly impact a company’s brand reputation. Consumers today are more likely to support and stay loyal to brands that are environmentally conscious, socially responsible, and uphold strong governance principles.

Incorporating ESG into Business Strategy: A Roadmap

Now that we understand the significance of ESG, it’s time to explore how companies can integrate these principles into their business strategies effectively.

1. Conduct a Materiality Assessment:

Identify the ESG factors that are most relevant to your company’s industry, operations, and stakeholders. This will help you prioritize your efforts and allocate resources efficiently.

2. Set Clear ESG Goals:

Establish measurable ESG goals that align with your company’s overall mission and values. These goals should be ambitious yet achievable, enabling your organization to track its progress over time.

3. Foster Collaboration and Engagement:

ESG initiatives require a collective effort from all levels of the organization. Engage your employees, management team, and board of directors to build a shared commitment towards sustainability and social responsibility.

4. Transparent Reporting:

Communicate your company’s ESG efforts through regular, transparent reporting. This not only fosters accountability but also showcases your dedication to transparency and responsible governance.

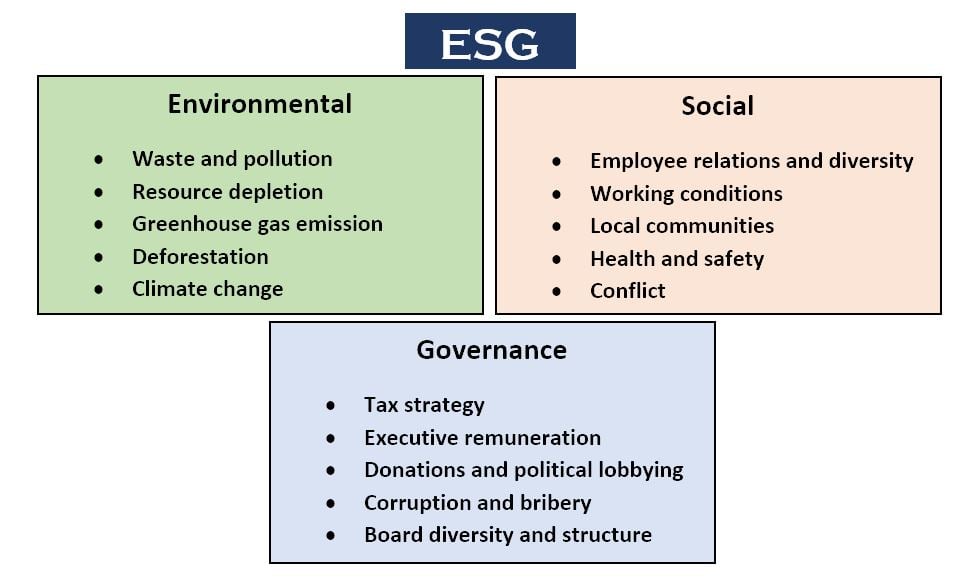

ESG’s three central factors are:

Environmental criteria, which examines how a business performs as a steward of our natural environment, focusing on:

- waste and pollution

- resource depletion

- greenhouse gas emission

- deforestation

- climate change

Social criteria, which looks at how the company treats people and concentrates on:

- employee relations & Diversity

- working conditions, including child labor and slavery

- local communities; seeks explicitly to fund projects or institutions that will serve poor and underserved communities globally

- health and safety

- conflict

Governance criteria, which examines how a corporation polices itself – how the company is governed and focuses on:

- tax strategy

- Executive remuneration

- donations and political lobbying

- corruption and bribery

- board diversity and structure

If you are an investor and would like to buy ESG-screened securities you should consider socially responsible mutual funds and exchange-traded funds.

Experts say that what constitutes an appropriate set of ESG criteria is subjective – it depends on what your priorities are – so you will need to do the research yourself if you really want to seek out investments that precisely match your own values.

ESG and the alternative investment world

ESG standards are gradually becoming a significant part of the alternative investment world. ESG issues are not only important when measuring the sustainability of the non-financial impacts of investments – but they may also have a material impact on the return profile and long-term risk of investment portfolios.

A recent study found that investors who choose ESG-screened investments receive a ‘double dividend’ in the form of lower risk plus a better **rate of return.

** Rate of return is the ratio of the income from an investment over its starting cost.

It has been found that businesses that adopt ESG standards tend to be more conscientious, less risky, and consequently more likely to be successful in their long-term commercial aims.

Traditional investors are becoming increasingly interested in the ESG framework, and many have begun using its criteria for assessing risk in the investment decision-making process.

According to TriLinc Global LLC, a private investment management company dedicated to launching and managing innovative products”

“ESG standards provide another level of due diligence, which is in the best interest of shareholders. When the UN launched UNPRI in 2006 and watchdogs like Bloomberg and MSCI started tracking ESG, it became abundantly clear that this was not a short-lived fad.”

“ESG weeds out unsustainable companies with outdated practices and harmful side effects, while also minimizing risk for investors as they invest in more responsible companies with a greater likelihood of succeeding in the long run.”

ESG-screened investments are good investments

The practice of considering environmental, social, and governance issues when seeking out investment opportunities has evolved considerably from its origins.

Several different methods are currently being used by both value-motivated and values-motivated investors in considering ESG issues across all classes of assets.

It is a myth to think that socially responsible investing comes at a cost – that you will make less money – in fact, the opposite is often the case.

In an article published by the *CFA Institute last year – Environmental, Social, and Governance Issues in Investing: A Guide for Investment Professionals – Usman Hayat, CFA, and Matt Orsagh, CFA, CIPM wrote:

“There is, however, a lingering misperception that the body of empirical evidence shows that ESG considerations adversely affect financial performance.”

“For investment professionals, a key idea in the discussion of ESG issues is that systematically considering ESG issues will likely lead to more complete investment analyses and better-informed investment decisions.”

* The CFA Institute, based in Charlottesville, Virginia, offers the Chartered Financial Analyst (CFA) designation.

In another paper published by the CFA Institute –Integrating ESG into the Fixed-Income Portfolio – Christoph Klein CFA claims that integrating ESG criteria into the fixed-income analysis can reduce idiosyncratic and portfolio risk, while at the same time improving performance by “helping investors anticipate and avoid investments that may be prone to credit rating downgrades, widening credit spreads, and price volatility.”

The Financial Times Lexicon says the following regarding Environmental, Social and Governance:

“ESG (environmental, social and governance) is a generic term used in capital markets and used by investors to evaluate corporate behaviour and to determine the future financial performance of companies.”

“ESG factors are a subset of non-financial performance indicators which include sustainable, ethical and corporate governance issues such as managing the company’s carbon footprint and ensuring there are systems in place to ensure accountability.”

People’s attitudes are changing

Google and Impax carried out a survey of over 300 investors with £500,000 ($700,000) or more of long-term savings and investments. The aim was to determine what their attitudes to climate change were following the COP21 Conference in Paris.

Below are some of the survey’s findings:

- 70% of respondents said they were concerned about climate change.

- 15.3% said they had taken steps of both investing in sustainable/clean energy stocks plus not investing in fossil fuels.

- 33.5% claimed to currently have investments that are focused on clean energy, energy efficiency, or sustainability.

Writing in the Financial Times, Nyree Stewart quotes Hamish Chamberlayne, an SRI manager at Henderson Global Investors, who said:

“The big picture is that in the next few decades, the global economy is going to transform to a low-carbon economy and it will be one of the biggest investment events of our lifetime.”

“We have a global economy that is roughly $80trn [£56.3trn] and extremely dependent on carbon, so transitioning to an economy where we are much less dependent on carbon will result in enormous disruption to established industries and geopolitical relationships and how the global economy works. In the next 10-20 years there will be huge risks and opportunities.”

https://tube.rvere.com/embed?v=1GTmreIkt48

The Hear UP is a leading technology publication house. Our origin dates back to 2016 as a small forum for technology enthusiasts. Since then, The Hear UP has transformed into a trusted source for emerging tech and science news.

The majority of our news is provided by staff writers. Other news is provided by news agencies and freelancers.

All of our contributors are members of the Society of Professional Journalists.

If you need to contact a news editor from The Hear UP you can find a list of email addresses on our contact page.

Our Organisation

The Hear UP