NEWS

Ways To Encourage Kids to Learn Financial Literacy

Money management is a crucial skill that affects every aspect of our lives, yet it’s often overlooked in traditional education. As parents, we have the opportunity and responsibility to instill financial literacy in our children from an early age. By teaching them the value of money, budgeting, debt resolution and smart spending habits, we can empower them to make informed financial decisions in the future. Let’s explore some effective ways to encourage kids to learn financial literacy.

Setting the Stage for Financial Success

Just as we teach our children to brush their teeth and eat their vegetables, it’s important to instill good financial habits from a young age. By introducing concepts like saving, budgeting, and responsible spending early on, we can lay the foundation for a lifetime of financial success. Research suggests that many of our financial habits are formed by age seven, so starting early is key to shaping your child’s financial future.

The Role of Debt Resolution

Debt resolution is an important aspect of financial literacy that often goes overlooked. Teaching kids about the consequences of debt and how to effectively manage and resolve it is crucial for their financial well-being. By discussing real-life scenarios and encouraging open communication about money, parents can help their children develop the skills they need to navigate the complex world of personal finance.

Making Learning Fun

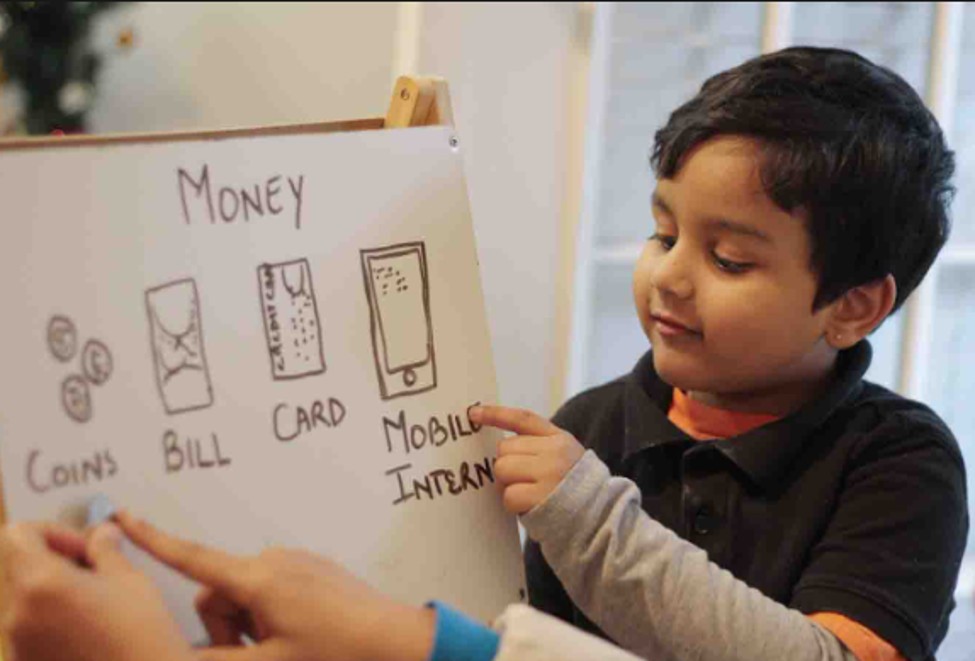

Learning about money doesn’t have to be boring. In fact, incorporating games, activities, and real-life experiences can make financial literacy fun and engaging for kids. Consider setting up a pretend store where children can practice counting money and making change, or play board games that teach valuable financial concepts like budgeting and investing. By making learning interactive and enjoyable, you can capture your child’s interest and enthusiasm for financial literacy.

Leading by Example

Children learn by example, so it’s important for parents to model good financial behavior. Practice what you preach by demonstrating responsible money management skills and discussing financial decisions openly with your children. Show them how to create a budget, save for goals, and make informed purchasing choices. By serving as positive role models, parents can reinforce the importance of financial literacy and set their children up for success.

Empowering Independence

As children grow older, encourage them to take on more responsibility for their finances. Give them opportunities to earn money through chores or part-time jobs, and help them set savings goals for things they want to buy. Allow them to make their own spending decisions (within reason) and experience the consequences of their choices. By empowering children to take control of their finances, parents can help them develop confidence and independence.

Conclusion

Teaching kids about financial literacy is one of the most valuable gifts parents can give. By starting early, incorporating fun and interactive learning experiences, and leading by example, parents can empower their children to make smart financial decisions and build a secure financial future. By instilling good money habits from a young age, parents can help their children avoid the pitfalls of poor money management and set them on the path to financial success.