POLITICS

Integrasi PNM: Streamlining Financial Services for Micro Enterprises

In Indonesia, small businesses Integrasi PNM and micro-enterprises are a crucial part of the economy, providing employment opportunities and contributing to local communities. However, access to financing and financial services is often limited for these businesses, making it difficult for them to grow and thrive. PNM (Permodalan Nasional Madani) is a state-owned company that aims to address this issue by providing financial services and assistance to micro-enterprises. In this article, we will discuss PNM’s role in promoting financial inclusion for micro-enterprises and how its integration with other financial services can further benefit these businesses.

Table of Contents

- Introduction

- Understanding PNM

- PNM’s Mission and Objectives

- PNM’s Target Market

- PNM’s Services and Products

- The Importance of Financial Inclusion for Micro-enterprises

- Challenges Faced by Micro-enterprises

- Benefits of Financial Inclusion

- Integrating PNM with Other Financial Services

- The Role of Digital Banking

- The Benefits of Collaboration

- Conclusion

- FAQs

1. Introduction

Small businesses and micro-enterprises play a vital role in Indonesia’s economy, but often struggle to access the financial services they need to grow and succeed. PNM is a state-owned company that aims to address this issue by providing financial services and assistance to micro-enterprises. In this article, we will explore PNM’s role in promoting financial inclusion for micro-enterprises and how its integration with other financial services can further benefit these businesses.

2. Understanding PNM

PNM’s Mission and Objectives

PNM’s mission is to provide financial services and assistance to micro-enterprises in Indonesia. The company’s primary objective is to promote financial inclusion by providing micro-enterprises with access to financing and other financial services. PNM aims to support micro-enterprises in various sectors, including agriculture, trade, and services.

PNM’s Target Market

PNM’s target market is micro-enterprises in Indonesia, specifically those that have difficulty accessing traditional financial services. These businesses may lack the collateral or credit history required by banks to obtain loans or credit. PNM aims to provide these businesses with access to financing and other financial services to support their growth and development.

PNM’s Services and Products

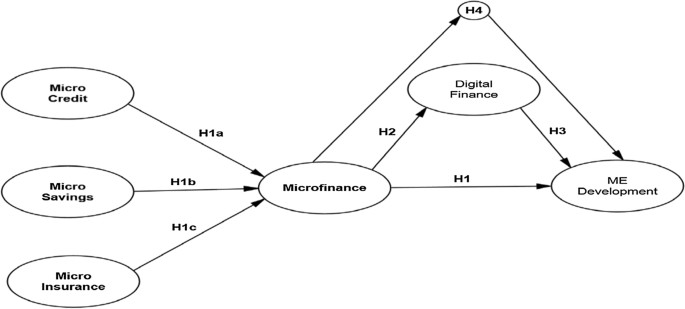

PNM provides various financial services and products to micro-enterprises, including:

- Microcredit

- Micro-savings

- Micro-insurance

- Training and education

PNM’s microcredit program provides small loans to micro-enterprises that may not have access to traditional financing. The micro-savings program allows micro-enterprises to save and earn interest on their deposits. PNM’s micro-insurance program provides insurance coverage for micro-enterprises and their assets. PNM also provides training and education programs to help micro-enterprises improve their financial literacy and management skills.

3. The Importance of Financial Inclusion for Micro-enterprises

Challenges Faced by Micro-enterprises

Micro-enterprises face various challenges when it comes to accessing financial services. Traditional financial institutions often require collateral and a credit history, which many micro-enterprises do not have. Micro-enterprises may also lack the knowledge and skills needed to manage their finances effectively. This lack of access to financial services and knowledge can limit the growth and development of micro-enterprises.

Benefits of Financial Inclusion

Financial inclusion can provide numerous benefits for micro-enterprises. Access to financing and other financial services can enable micro-enterprises to invest in their businesses, purchase equipment and supplies, and expand their operations. Financial inclusion can also help micro-enterprises manage their cash flow and improve their financial stability. Additionally, financial inclusion can improve the overall

The Hear UP is a leading technology publication house. Our origin dates back to 2016 as a small forum for technology enthusiasts. Since then, The Hear UP has transformed into a trusted source for emerging tech and science news.

The majority of our news is provided by staff writers. Other news is provided by news agencies and freelancers.

All of our contributors are members of the Society of Professional Journalists.

If you need to contact a news editor from The Hear UP you can find a list of email addresses on our contact page.

Our Organisation

The Hear UP